Micro Loan Malaysia

You can be in many kind of business sectors especially services or agriculture. Compare sustainable microfinance loans from partner banks with Bank Negara Malaysia and get lower loan rates from the micro enterprise fund.

Malaysia Sme Funding Guide 2020

The highest loan amount you can borrow through a personal loan in Malaysia is RM200000 depending on the financial institutions.

Micro loan malaysia. 1800 88 8668 Toll Free Operation Hour. Monday - Friday 900 AM - 600 PM Email. RM 1000 to RM 10000.

The implementation of the product is based on the Tawarruq transactions. Min 1 year in operation. Grow your startup funding with a micro business loan to help your working capital and credit score.

Looking for the best personal loan in Malaysia. You can be in many kind of business sectors especially services or agriculture. Group-5 members per group.

Our aim is to provide satisfactory and smart loans for clients to benefit them in repaying low interest in the long run. Registered under the Companies Commission of Malaysia Act 2001 or Co-operative Societies Act 1993. Compare Personal Loans in Malaysia 2021.

1 2 years. However your salary also plays a part in determining the loan amount that you qualify for. Applicant must be a Micro Enterprise Company with.

Contact MPEB for more information. Lot 1901 Level 19 Tower 1 Faber Towers Jalan Desa Bahagia Taman Desa 58100 Kuala Lumpur Malaysia. The government has decided to abolish loan interest for micro credit schemes under the Prihatin economic stimulus package.

Contact MPEB for more information. We provide instant approval on your loan without delay. He said small and medium-sized enterprises SMEs will also enjoy rental discounts for business premises similar.

Emicro Instant Loan Malaysia - Apply Now. Therefore this loan is perfect for small startups in the youth category. Companys years of operation.

There are 3 important aspects that you need to know before making your business loan application in Malaysia. Use the personal loan calculator to check for your monthly repayments and apply online for free. Age between 21 60 years.

The company is in operations for at least 2 years and profitable in current year. Must not have any adverse track record with any Financial Institutions. Some of the notable eligibility criteria.

With Funding Societies Micro Financing you can apply for a financing amount of up to RM100000 with an interest rate of 08 - 15 per month with a tenure of up to 18 months. STEB is a micro loan pinjaman mikro which means that the loan amount is from RM5000 RM50000. Valid business license permit business registration.

As a rule of thumb a borrower can typically borrow up to four times hisher monthly salary. Welcome to Micro Personal Loan MPL Malaysias trusted loan lender to ease your financial burden with low interest rates. Kredit Mikro is an uncollateralised micro financing for business purposes.

Minimum Turnover of RM150000 annual sales. Prime Minister Tan Sri Muhyiddin Yassin said RM200 million has been allocated for the purpose. Compare and get a personal loan with interest rates as low as 32.

STEB is a micro loan pinjaman mikro which means that the loan amount is from RM5000 RM50000. This scheme has been supporting the financing needs of micro enterprises since 2006 under the National Sustainable Microfinance framework where micro businesses can access to financing at a lower rate from Micro Enterprise Fund that is established by Bank Negara Malaysia and is channelled through the PFIs of Pembiayaan Mikro. Receive application status as fast as 10 minutes.

Get approval within 24 hours. Once you have accepted our offer we will credit the approved financing amount to you with any fees deducted from the amount. Household income below RM24000 pa.

Amanah Ikhtiar Malaysia AIM httpwwwaimgovmy Objective To reduce poverty in Malaysia through the provision of interest free microcredit facilities to the poor and low-income households to finance income-generating activities and thus improve their standard of. Apply online and get financing up to RM50k disbursed within minutes. Provision of credit facilities to micro entrepreneurs to undertake economic activities involving agriculture and agro-based activities covering all stages of production processing.

Financing disbursement as fast as 1 minute. To qualify for a business loan application it is important that you own a company that has been operating for at least 1 to 2 years with proper documentations and records. Maybank Microfinance Conventional Islamic Loan Size.

Therefore this loan is perfect for small startups in the youth category.

Pdf Microfinance Performance In Malaysia

Malaysia Sme Funding Guide 2020

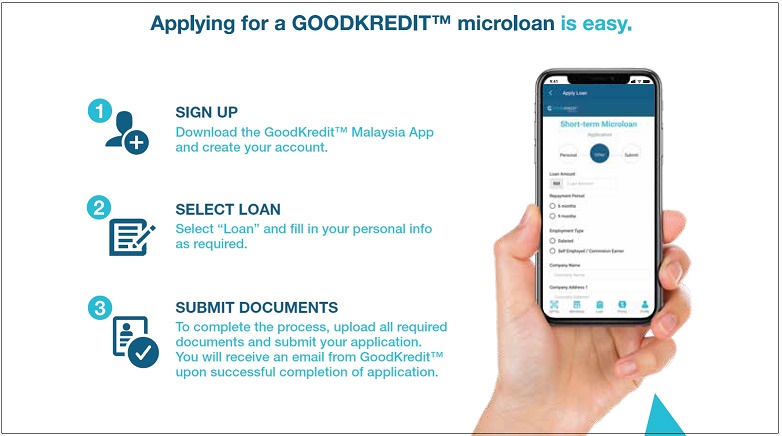

Goodkredit Brings Automated Short Term Micro Loans To Those In Need Digital News Asia

Financing For Small And Medium Enterprises Smes Bank Negara Malaysia

Financing For Small And Medium Enterprises Smes Bank Negara Malaysia

Pdf The Importance Of Micro Financing To The Microenterprises Development In Malaysia S Experience

Smes Can Apply For Bsn Micro I Kredit Prihatin Up To Rm75 000 With 0 Interest

Komentar

Posting Komentar